Why Financial Statements Are Important: A Beginner’s Guide

Financial Statements – Accounting is taken into consideration to be among those made complex yet required tasks that keep people’s economic events relatively tidy.재무제표 For the novice who is just beginning, the procedure may not be the initial challenge. Often, it is understanding the unique language made use of by accounting professionals and also those that function around them. In other words, one must wade through the lingo in order to comprehend what’s taking place. The primary step in acquiring understanding of accountancy is to damage ideas to one fundamental factor: financial declarations.

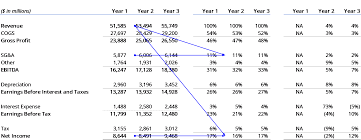

Corporations are extremely keen on economic statements– nevertheless, they are called for to have them. Financial declarations are, in a wider feeling, just timely statements of the economic situation of an organization. They hold firms accountable for exactly how money is gained as well as spent, to the really last detail. Financial statements are frequently audited by exterior auditors to make sure that the business is dealing with records properly. This additionally validates to 3rd parties that the company is displaying a reasonable as well as balanced sight of the organization’s setting. These are likewise called “cash flow statements”. Like most economic ideas, economic declarations can be broken down right into a number of smaller concepts. They are: annual report, capital declarations, and also revenue as well as loss accounts.

Capital declarations is an additional term for financial statements, yet a little a lot more certain. This statement reveals exactly where the cash goes– exactly how it was made, where it was made, as well as most importantly, how was it spent. A company, after all, has many locations where cash moves in and out: operating tasks, spending activities, funding activities.

To clear up, running tasks are the everyday internal company a business relies on to survive. This might include, but is not limited to: collecting money from customers, paying staff members and vendors, interest as well as tax obligations, and even income from passion payouts. Spending activities are usually financial investments made by the business to fund purchases of tools. Ultimately, funding tasks are those that affect the circulation of cash straight, such as the sale of common stock or modifications in long or temporary loans.

These calculations are after that made use of to discover the total increase (or reduction) in money as well as financial investments. Fluctuations in operations, investing, or funding influence cash flow. This is called the “net modification” in cash and also valuable protections. From here, these computations are checked versus the annual report.

Wait, a balance sheet? Isn’t that what we simply did, equilibrium?

No. A balance sheet sums up a firm’s possessions, liabilities, and also value at a specific moment. Investors want to the annual report to establish a firm’s value based on what the company has and what they owe to external sources. The amount of cash invested by the shareholders influences company worth in this way too. The annual report adheres to a particular formula, where possessions equivalent obligations plus shareholder’s equity. It is called an annual report since both sides have to balance out; besides, a business should spend for possessions by either obtaining the cash directly, or through investors. The balance sheet is plainly a wonderful resource of financial info on a firm.

The last line of protection, the profit and loss account, shows the tasks of a company throughout a time period. This differs from the annual report in that a profit and also loss account functions as a log of a business’s activities over a time period, while the annual report is just the financial position at a certain moment in time. Some worth the profit as well as loss account over the annual report, as it notes a much longer stretch of time than the balance sheet does.

When broken down right into components, economic statements are not such a hard topic to manage, also for a novice. Financial declarations expose the practices of a firm– while one does not get a certain plan of how a company makes or loses cash, completion outcomes are plainly presented for individuals to see.